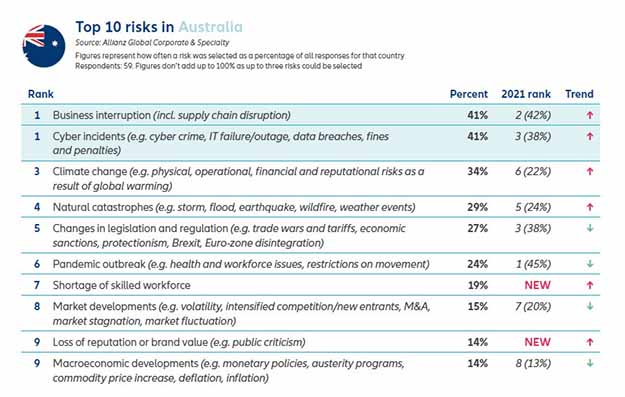

- 11th Allianz survey: Business interruption and Cyber incidents, are the top business risks for Australia in 2022

- Natural catastrophes (#4) and Changes in legislation (#5) are rising Australian risks

- Globally, Cyber, Business interruption and Natural disasters are the top three business risks in 2022

- AGCS CEO Joachim Mueller: “‘Business interrupted’ will likely remain the key underlying risk theme for this year. Building resilience is becoming a competitive advantage for companies.”

‘Business interruption’ and ‘Cyber incidents’ (joint #1 with 41% responses each) are the top Australian business risk for 2022, according to a global survey by leading corporate insurer, Allianz.

The 2022 Allianz Risk Barometer (PDF, 10.4MB) also found ‘Climate change’ (#3 with 34%) is a growing risk in Australia, up three spots from 2021; while ‘Natural catastrophes’ (#4 with 29%) continues to pose as a growing threat to business following two years significant wild weather events. ‘Changes in legislation and regulation’ (#5 with 27%) has been ranked within the top 5 risks for Australian businesses for the last five years.

The annual survey from Allianz Global Corporate & Specialty (AGCS) incorporates the views of 2,650 experts in 89 countries and territories, including CEOs, risk managers, brokers and insurance experts.

According to the survey, cyber perils are the biggest concern for companies globally in 2022, with ‘Cyber incidents’ being named the number 1 global threat for 2022 for only the second time in the survey’s history (44% of responses). The threat of ransomware attacks, data breaches or major IT outages worries companies even more than business and supply chain disruption, natural disasters or the COVID-19 pandemic, all of which have heavily affected firms in the past year.

‘Business interruption’ drops to a close second (42%) and ‘Natural catastrophes’ ranks third (25%), up from sixth in 2021. ‘Climate change’ climbs to its highest-ever ranking of sixth (17%, up from ninth), while ‘Pandemic outbreak’ drops to fourth (22%).

“‘Business interrupted’ will likely remain the key underlying risk theme in 2022,” AGCS CEO Joachim Mueller summarises. “For most companies the biggest fear is not being able to produce their products or deliver their services. 2021 saw unprecedented levels of disruption, caused by various triggers. Crippling cyber-attacks, the supply chain impact from many climate change-related weather events, as well as pandemic-related manufacturing problems and transport bottlenecks wreaked havoc. This year only promises a gradual easing of the situation, although further COVID-19-related problems cannot be ruled out. Building resilience against the many causes of business interruption is increasingly becoming a competitive advantage for companies.”