- Data breaches, attacks on critical infrastructure or physical assets and increased ransomware attacks drive global cyber concerns.

- Business interruption remains #2 globally with 31%. Natural catastrophes the biggest riser compared to 2023 with 26% in #3.

- Risk perception differs regionally for climate change, political risks and violence, and shortage of skilled workforce.

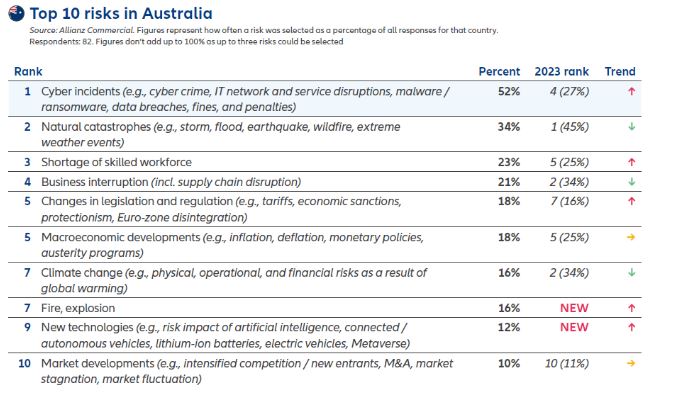

- Cyber has become the top issue for businesses moving from 4th to 1st in Australia with 52% saying it is a key concern.

- Impacts of Natural Catastrophes and Business interruption (including Supply chain disruption) continue to top of mind for businesses in Australia.

- Shortage of skilled workforce moved from 5th to 3rd place in Australia mainly driven by the hangover from Covid.

Cyber incidents such as ransomware attacks, data breaches, and IT disruptions are the biggest worry for companies globally in 2024, according to the Allianz Risk Barometer. The closely interlinked peril of Business interruption ranks second. Natural catastrophes (up from #6 to #3 year-on-year), Fire, explosion (up from #9 to #6), and Political risks and violence (up from #10 to #8) are the biggest risers in the latest compilation of the top global business risks, based on the insights of more than 3,000 risk management professionals.

Phuong Ly, Chief General Manager Allianz Australia Commercial commented “In Australia Cyber has become the top issue for businesses moving from the 4th place in 2023 to 1st place in 2024, which isn’t surprising, given some of the high profile cyber breaches that Australia witnessed in 2023. We encourage businesses to proactively understand their cyber security posture and ensure that the appropriate risk mitigations and insurance covers are in place.”

The other big mover in Australia was concerns around shortage of skilled workforce which has moved in rankings from 5th to 3rd place. This is driven predominately by a shortage of workers in the hospitality, tourism and manufacturing sectors left after Covid, as well as a genuine shortage in skilled labor particularly in the healthcare and technology sectors”.

Phuong continued “Interestingly we have a new entry at 9th place which is New Technologies (eg. AI, Lithium batteries EV etc.) This is understandable since many organisations are still grappling on how to adopt new technologies whilst balancing the ethical and safety issues. At Allianz in Australia, we have seen a huge impact when it comes to lithium batteries in household appliances and e-bikes/scooters and increased claims”.

Allianz Global Commercial CEO Petros Papanikolaou comments on the findings: “The top risks and major risers in this year’s Allianz Risk Barometer reflect the big issues facing companies around the world right now – digitalization, climate change and an uncertain geopolitical environment. Many of these risks are already hitting home, with extreme weather, ransomware attacks and regional conflicts expected to test the resilience of supply chains and business models further in 2024. Brokers and customers of insurance companies should be aware and adjust their insurance covers accordingly.”

Large corporates, mid-size, and smaller businesses are united by the same risk concerns – they are all mostly worried about cyber, business interruption and natural catastrophes. However, the resilience gap between large and smaller companies is widening, as risk awareness among larger organizations has grown since the pandemic with a notable drive to upgrade resilience, the report notes. Conversely, smaller businesses often lack the time and resources to identify and effectively prepare for a wider range of risk scenarios and, as a result, take longer to get the business back up and running after an unexpected incident.