Report a scam

Email scams

What to look for in email scams

- Incorrect branding or spelling.

- Instructions to click on links or download attachments.

- A sense of urgency or attempt to rush, scare, or entice you.

- A strange web address (URL) when you hover over the link in the email.

- Lookalike email addresses or display names that impersonate Allianz. For example, these aren't legitimate email addresses:

Legitimate emails include:

Known email scams

- Counterfeit Allianz investment product materials to entice individuals to invest in a non-existent bond product. This activity is completely unaffiliated with Allianz.

- Emails containing false claim information related to current event topics (fires, floods, and other catastrophic events) to deceive people who may be in vulnerable situations or currently engaged with us about a real claim. The email may involve requests to reveal personal information, login information such as passwords, bank details, or to make a payment quickly before a consequence is applied.

Phone and SMS scams

What to look for in phone and SMS scams

- Someone contacting you to confirm your personal information.

- Someone contacting you to ask you to provide urgent payment.

- Mobile text messages with suspicious links.

- Mobile text messages or phone callers detailing a consequence or threat, if you don’t undertake the action they are telling you to do.

Known phone and SMS scams

- A text message asking you to make a payment (for example, $200) to avoid debt recovery action being taken. It may include generic details about your place of work or products you’ve bought such as Allianz insurance. The text message will ask you to click a link or call a number not associated with us.

- Phone calls from unaffiliated individuals claiming to be from Allianz. There may be many reasons for their call, however they may ask:

- To verify and update your details or your policy will be cancelled.

- For access to your computer.

- For your bank details, personal information, or your password.

- For you to download an application on your mobile phone, tablet or computer.

- To transfer a payment in order to prevent consequences such as debt recovery, cancelled policies or cancelled pay-outs.

Repairer scams

What to look for in repairer scams

- Unknown people or repairers contacting you to discuss your claim, where you’re unsure if they’re from Allianz.

- Documentation authorising repairs, storage, quotes, or other information related to the repair of your vehicle.

- Incorrect website or phone contact information for Allianz.

Additional repairer claims information

We can recommend one of our Selected Repairers at the time a claim is lodged as they offer fast, high-quality service, or you can always choose your own repairer. We may also agree to pay you the reasonable cost of repairs, or the cars agreed, or market value, at our discretion.

Known repairer scams

- Third-party businesses asking customers to sign documents to give repairers a right to charge for storage costs, administration fees, and other items customers may not be entitled to under their insurance policy.

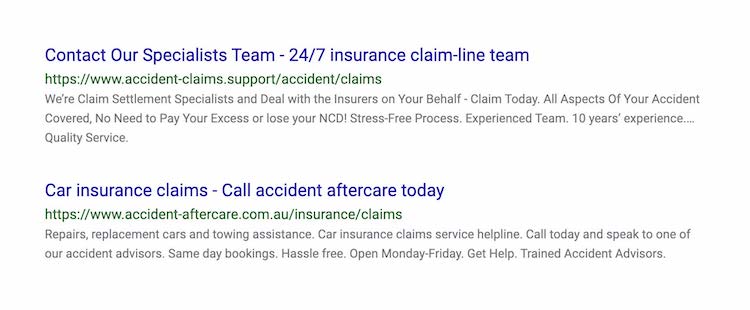

- Third-party businesses are misrepresenting themselves as Allianz in search engine results and can appear in search engines (such as Google) against search terms such as “Allianz claims” or “Allianz car insurance claims”. These links suggest they can assist customers with lodging claims, however, the number provided connects customers to a non-Allianz call centre or website where they’re prompted to divulge personal information.

We strongly recommend customers check the details of the website they’re clicking on and only click on links containing the official Allianz domain. Some recent examples of these scams include:

Your privacy is important

It’s common for scammers to use a technique called social engineering to find your personal information. This means a scammer may search the internet to find personal details about you, then try and use them to contact you and gain your trust.

We don’t disclose your personal information unless legally required to do so. For more information, visit our Privacy Policy.

Legitimate Allianz communications

We may contact you directly to talk about your policy or insurance refund. When we call, we might need to ask you for some information for our verification check so we can confirm we’re speaking to the right person.

If you’re unsure about the caller, or you don’t want to give your information for the verification check right away, you can choose to call us back, so you know you’re talking to us. We’ll never ask you for your passwords over the phone or through any other communication method.

Visit Contact Us to source the number best related to your enquiry.

Additional resources

eSafety

Scamwatch

IDCARE

We're here to help

Give us a call, or send us a message

Follow us on

Any advice here does not take into account your individual objectives, financial situation or needs. Terms, conditions, limits, and exclusions apply. Before making a decision about this insurance, consider the relevant Product Disclosure Statement (PDS)/Policy Wording and Supplementary PDS (if applicable). Where applicable, the PDS/Policy Wording, Supplementary PDS and Target Market Determination (TMD) for this insurance are available on this website. We do not provide any form of advice if you call us to enquire about or purchase a product.

Allianz Australia Insurance Limited ABN 15 000 122 850 AFS Licence No. 234708 is the insurer of any general insurance products offered, and Allianz Australia Life Insurance Limited ABN 27 076 033 782 AFS Licence No. 296559 is the insurer of any life insurance products offered. Each entity is responsible for any statements and representations made about its products, on this website.